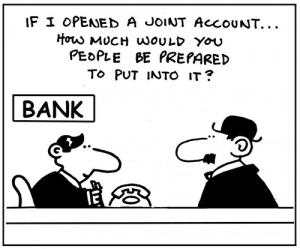

Stay Away From Expensive Joint Accounts!

Few things cause more trouble than titling assets jointly, especially bank accounts. What does it mean if your name is on someone else’s bank account? It depends.

For all deposit accounts, the rights of the parties to a multiple-party account are determined under the Pennsylvania Multiple-Party Account Act. Here is the applicable provision:

2010 Pennsylvania Code Title 20 – DECEDENTS, ESTATES AND FIDUCIARIES Chapter 63 – Multiple-Party Accounts 6304 – Right of survivorship. § 6304. Right of survivorship.

(a) Joint account.– Any sum remaining on deposit at the death of a party to a joint account belongs to the surviving party or parties as against the estate of the decedent unless there is clear and convincing evidence of a different intent at the time the account is created. If there are two or more surviving parties, their respective ownerships during lifetime shall be in proportion to their previous ownership interests under section 6303 (relating to ownership during lifetime) augmented by an equal per capita share for each survivor of any interest the decedent may have owned in the account immediately before his death; and the right of survivorship continues between the surviving parties.

(b) Trust account.– At the death of the trustee or the survivor of two or more trustees, any sum remaining on deposit belongs to the person or persons named as beneficiaries, if surviving, or to the survivor or survivors of them if one or more die before the trustee or last surviving trustee, unless there is clear and convincing evidence of a contrary intent; if two or more beneficiaries survive, there is no right of survivorship in event of death of any beneficiary thereafter unless the terms of the account or deposit agreement expressly provide for survivorship between them.

(c) Other cases.– In other cases, the death of any party to a multiple-party account has no effect on beneficial ownership of the account other than that the rights of the decedent become part of his estate.

(d) Change by will prohibited. — A right of survivorship arising from the express terms of an account or under this section, or a beneficiary designation in a trust account cannot be changed by will.

A joint account is one that is payable on request to one or more parties whether or not any mention is made of survivorship. If you and your mother have a joint account, and either one of you may write checks on the account or make withdrawals from the account, this is a joint account.

Who can write checks and make withdrawals is determined by the deposit agreement with the bank or other financial institution. How your names appear on a statement or on checks is not determinative. The rights of the parties are determined by what is in the account agreement.

Who owns a joint account during the lifetime of the joint parties? According to the Multiple-Party Account Act, a joint account belongs to the parties in proportion to the net contributions of each party to the deposit unless there is clear and convincing evidence of a differing intent.

For Example: You and Mom have a joint account. All of the funds in the account were deposited from Mom’s earnings. During the lifetimes of you and your mother, the money in the account belongs to your mother.

Note that the bank is not going to keep track of whose money is in the account. The bank may pay the whole of the account to either one of you in accordance with its deposit agreement. If you make a withdrawal or write a check to yourself, it is either a gift to you or you owe a debt to your Mother.

On the death of one party, the joint account belongs to the surviving joint owner or owners unless there is “clear and convincing evidence of a different intent at the time the account is created.” For example, if you and Mom have a joint account and Mom dies, unless there is clear and convincing evidence to the contrary, the account belongs to you on Mom’s death.

Convenience Accounts

There are many arguments over accounts that are made joint for “convenience.”

If Mom puts your name on a bank account as a joint owner so that it is easy for you to write checks for her to pay her bills, but she does not intend that the account pass to you on her death, that is what is referred to as a convenience account.

The account is in joint names only for convenience, not because it was intended to pass to the check writer by right of survivorship on Mom’s death.

Unfortunately, after Mom is deceased; it is very hard to determine what her intention was, especially if the surviving joint owner asserts that Mom intended the ownership of the account to pass to the survivor.

The statute presumes that the account passes to the surviving joint owner. It is up to the other claimants to prove that Mom had a different intention, proven by clear and convincing evidence.

Because of the many problems of proof and the opportunity for heirs and beneficiaries to argue, I never recommend convenience accounts. It is far better to use a power of attorney. Then, there is no confusion as to who owns the funds.