How Does the New Tax Law Affect You?

The Tax Cuts and Jobs Act 2017 (TCJA) changes are effective for 2018. The 500 page law makes lots of changes but the net effect across the board is a very small benefit to low and middle income taxpayers, and more benefits for the very wealthy.

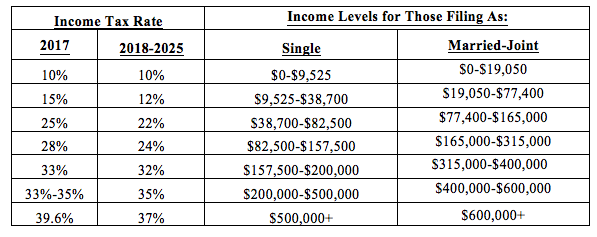

The new law keeps the seven income tax brackets but reduces rates:

According to Barron’s, taxpayers earning less than $25,000 will keep 0.4% or an extra $60 in their pockets for the 2018 year. Taxpayers earning between $49,000 and $86,000 will keep an extra 1.9% or $900. Taxpayers who earn $308,000 to $733,000 will keep an extra 4.1 % or $13,500. Those who earn over $500,000 will keep 3.4% extra or $51,000.

Many taxpayers who used to itemize their deductions will no longer be itemizers. The standard deduction has been doubled. You only itemize if your itemized deductions are greater than the standard deduction.

A single filer’s standard deduction increased from $6,350 to $12,000. The deduction for married joint filers increased from $12,700 to $24,000. You only itemize if itemized deductions exceed the standard deduction. The combination of the increased standard deduction and elimination or reduction of some itemized deduction means that about 94% of people will take the standard deduction.

The new law also eliminates personal exemptions, although it increases the Child Tax Credit from $1,000 to $2,000 per child and increases the qualifying income level from $110,000 to $400,000 for married taxpayers who file jointly.

The deduction for mortgage interest is limited to the interest on the first $750,000 on the loan. Interest on home equity lines of credit can no longer be deducted.

You can deduct only up to $10,000 in state and local taxes and must choose whether to deduct state income tax or state and local sales tax.

The medical expense deduction is expanded. All taxpayers can deduct medical expenses greater than 7.5% of adjusted gross income. The threshold used to be 10% for taxpayers born after 1952.

Moving expenses are no longer deductible except for the military. The law retains deductions for charitable contributions and student loan interest.

After January 1, 2019, alimony is no longer deductible by the payer spouse and will not be reported as income by the recipient spouse. Under the old law, alimony was deductible by the payer and included as income for the recipient spouse. The old-law treatment will continue for alimony payments made under pre-2019 divorce agreements unless it is modified after January 1, 2019 and the modification specifically states that the TCJA treatment now applies.

The Obamacare tax on those without health insurance (known as the individual mandate) is repealed.

The estate tax exemption is raised to $11.2 million

529 plans can now be used for tuition at private and religious K-12 schools and for expenses of home-schooled students.

Do you have questions about a specific matter? Contact us now.